New Bill of Rights

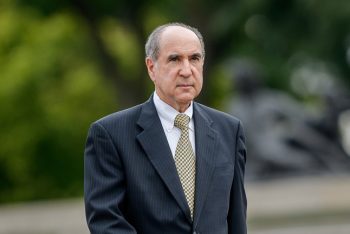

By Robert D. Kaplow

A new Bill of Rights has been adopted! No, our Bill of Rights set forth in the Constitution is still in existence. However, the Internal Revenue Service has now issued its own “Taxpayer Bill of Rights”, which also consists of ten rights. These Bill of Rights incorporate existing rights that are contained within the Internal Revenue Code, but have been restated to make them easier for the taxpayer and the Internal Revenue Service to understand and follow. These Bill of Rights were adopted following extensive discussions with the Taxpayer Advocate Service, which is an independent office inside the Internal Revenue Service that represents the interests of U.S. taxpayers.

Here are the taxpayer rights that we all have:

- The right to be informed.

- The right to quality service.

- The right to pay no more than the correct amount of tax.

- The right to challenge the IRS’s position and be heard.

- The right to appeal an IRS decision in an independent forum.

- The right to finality.

- The right to privacy.

- The right to confidentiality.

- The right to retain representation.

- The right to a fair and just tax system.

In issuing the Taxpayer Bill of Rights, IRS Commissioner, John A. Koskinen, said “I also want to emphasize that the concept of taxpayer rights is not a new one for IRS employees; they embrace it in their work every day. However, our establishment of the Taxpayer Bill of Rights is also a clear reminder that all of the IRS takes seriously our responsibility to treat taxpayers fairly.”

At Maddin Hauser, we have been dealing with the IRS for many years on behalf of our clients. Our tax attorneys are experienced in representing taxpayers before the IRS, both at the IRS agent level and in court. While we appreciate that the IRS has issued these Taxpayer Bill of Rights, it is our job, on your behalf, to make sure that the IRS recognizes your rights in any matter you have with the IRS.

The Internal Revenue Service has created a special section on its website to highlight the ten rights and it also provides further explanations about each of these rights. While many taxpayers have felt that they do not have any rights, the IRS is reaffirming that all taxpayers do have rights. At Maddin Hauser, we will do our best to enforce your rights on your behalf. Although there are not any specific enforcement provisions in connection with the Taxpayer Bill of Rights, at least the IRS is now adopting a policy to recognize that the taxpayer is the customer of the IRS. These broad rights were intended to reaffirm the IRS’s commitment to make taxpayers aware of their statutory and administrative protections.

Please contact any of the Maddin Hauser tax team members for tax related questions or issues.